LVR Calculator

Use this calculator to determine your Loan-to-Value Ratio (LVR) and understand how it impacts your borrowing potential and costs.

4.8 (1,650+ Reviews)

LVR Calculator

What Is Loan-To-Value Ratio (LVR)?

The Loan-to-Value Ratio (LVR) is a financial term that compares the amount of the loan to the value of the property being purchased, expressed as a percentage.

Put simply, the LVR of your loan is the percentage of the property value that you’re borrowing.

Lenders use LVR to assess risk, with lower LVRs generally indicating reduced risk for lenders.

How To Calculate LVR

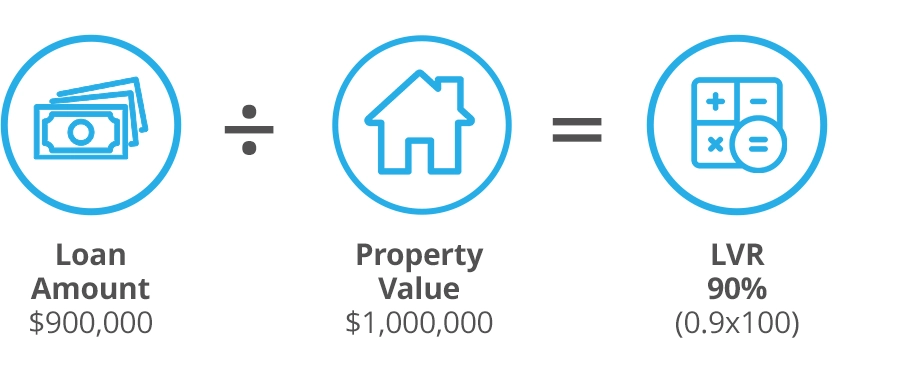

Your LVR is calculated by dividing the loan amount (the amount you’re borrowing) by the property value and then multiplying the result by 100 to express it as a percentage.

Mathematically, LVR = (Loan Amount ÷ Property Value) × 100

This formula expresses the loan amount as a percentage of the property’s value.

For example, if you borrow $900,000 against a $1 million property, your LVR is 90%.

LVR = (900,000 ÷ 1,000,000) × 100

How Does LVR Affect Your Home Loan?

The Loan-to-Value Ratio (LVR) influences various aspects of your home loan, including the interest rates you’re offered, potential additional costs like Lenders Mortgage Insurance (LMI), and your chances of securing loan approval.

LVR Percentages And Their Implications

Each LVR percentage carries specific consequences regarding loan approval, interest rates, and additional costs such as Lenders Mortgage Insurance (LMI).

LVR Below 80%

LVR Between 80% and 95%

LVR Above 95%

Make Informed Decisions With The 360° Home Loan Assessor

FAQs

How Does Property Valuation Affect My LVR

When applying for a home loan, lenders assess the property's value through their own valuation process, which may differ from the purchase price. If the bank's valuation is lower than the purchase price, your LVR will increase because you must borrow a larger proportion of the property's value.

For instance, if you intend to borrow $450,000 for a property valued at $600,000 (75% LVR) but the lender values it at only $530,000, your LVR would rise to about 85%, potentially requiring you to pay LMI.

Conversely, if the lender's valuation is higher than the purchase price, your LVR decreases, which could result in more favourable loan terms and lower interest rates, since you are borrowing a smaller percentage of the property's value.

What Is A Good LVR For A Home Loan?

What Is The Maximum LVR For A Home Loan?

The maximum LVR for a home loan is 100%, under a guarantor home loan.

The maximum varies among lenders. Some will accept a maximum LVR of 90% to 95%, while others might cap their LVR at 80% and below.

Can I Avoid Lenders Mortgage Insurance (LMI)?

Yes, you can avoid Lenders Mortgage Insurance through any one or a combination of the following strategies:

Does LVR Affect Refinancing?

What Are The Benefits Of A Lower LVR?

The benefits of a lower LVR are:

Still need answers? We're here to help!

Our team of mortgage experts will assist you within 24 hours.

Relevant Areas

Calculate Your LVR

Find out your Loan-to-Value Ratio by dividing your loan amount by the property value, expressed as a percentage. This helps you understand where you stand with lenders.

Determine Borrowing Thresholds

See if your LVR meets lender requirements. Most lenders prefer an LVR of 80% or lower to avoid additional costs like Lenders Mortgage Insurance (LMI).

Plan Your Deposit Size

Understand how increasing your deposit can reduce your LVR, helping you save on costs and potentially qualify for better interest rates.

Understand LVR Impact on Costs

Learn how a high LVR affects your home loan, including higher interest rates, LMI premiums, and stricter lender conditions.

Compare Loan Scenarios

Experiment with different loan amounts and property values to see how changes in your borrowing strategy impact your LVR.

Explore LVR Waiver Opportunities

Discover programs or lender offers that may waive LVR restrictions for certain professionals or specific loan products.

Trust Sunrise Finance WA To Help You

We have thousands of five-star reviews and testimonials on Product Review, Google Review and Facebook.

What Our Customers Say About Us

Vikam Khokher

Vijay Samdhyan

Jordan

Glenn Ramiez

Reuben David

Ravinder Kalyan

a specialist mortgage broker today.